Every individual dreams of buying a home, but the lengthy process is a major turn-off. It is a lifetime investment, and the decision should be made after a lot of study and research. It also involves some amount of risk regarding the authenticity of the project, its location, resale value, etc. Hence, studying the market and having a clear home-buying checklist is important for everyone.

Why do you need a home buying checklist? A home-buying decision needs a lot of time and patience. If you don’t know exactly what to do, then you might end up taking the wrong step or getting stuck at some point. A home buying checklist helps you to make a calculated move. It gives you a list of steps in a sequential order to make your home-buying experience hassle-free.

Your 12-point Home Buying Checklist

This handy home-buying checklist will enable a smooth home-buying experience. Here are 12 things you should check out before you buy a house.

1. Finalising Budget

The first and foremost thing to do on a home buying checklist is to finalise the budget. You need to calculate the amount of money that you can shell out for buying a house without going overboard. Add all your savings for making the down payment, and if you don’t have enough cash, then you can always go for a home loan. Check with different banks for better loan options. If you are a bank employee, you can avail of attractive features offered by banks for their employees. You can get lower home loan interest rates, higher loan amounts, more accessible eligibility criteria and longer repayment tenure.

2. Selecting a Suitable Location

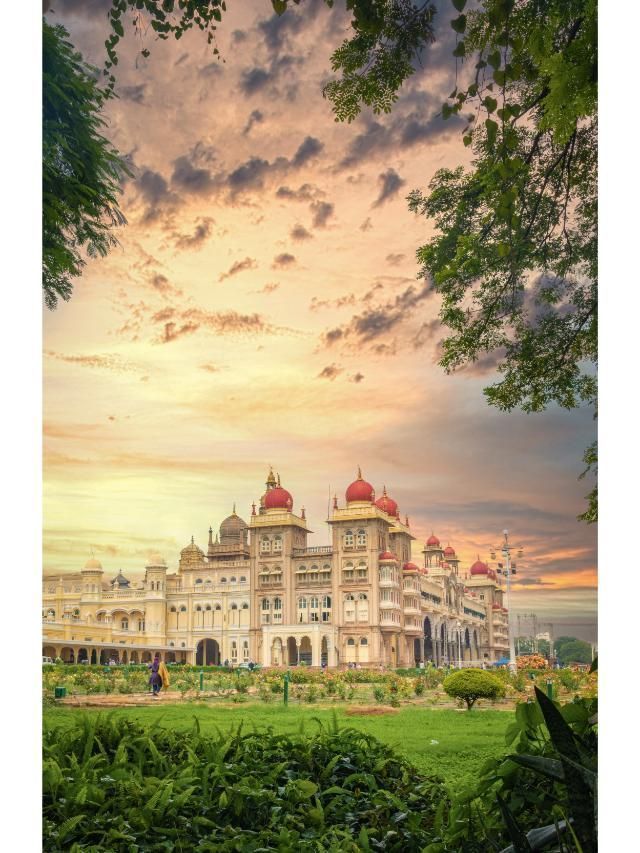

Shortlist the localities where you would like to invest in. Talk to your family members about their conveniences and preferences. If you and your wife are working, check the distance from your respective offices and also assess the travel time your kid would spend while commuting to school. If you are living with senior citizens, check for basic amenities, like hospitals, banks, and shopping complexes in the vicinity. Being close to the main road is always an added advantage as you will get quick access to public transport. Read reviews about the locality, have a word with the residents and enquire about the availability of water and power, upcoming projects in the locality etc. Choosing a desirable location is necessary because desirability creates demand, and demand raises the resale value of the property.

Zeroing down a location is a part of the home buying checklist

3. Size and Type of Home

One of the most important steps in the home buying checklist s to consider the size and type of home that best suits your needs and preferences. This decision can significantly impact your lifestyle and overall satisfaction with your new home, so it's essential to consider it carefully. Factors to consider include:

- The number of bedrooms and bathrooms.

- The size of the yard.

- The layout of the home.

- The style of architecture.

Additionally, evaluate whether you want an independent floor, an apartment, a bungalow or another type of property, as each has unique advantages and disadvantages.

Ultimately, carefully considering the size and type of home you want can help you find a property you will love for years to come.

4. Verifying Documents

If you are planning to buy a ready-to-move home or apartment, don’t forget to check the sale deed. Checking the sale deed tops the home buying checklist as it is the legal registered document which is the proof of sale and transfer of property. Before signing the deed it is recommended to scan it thoroughly. Check for the Completion and Occupancy Certificate issued by the municipal authorities and local government agencies respectively. Banks will ask for these documents before disbursing the loan. Also, verify if the building plan has been approved by the local authorities to avoid any problems in the future. To make sure that the property is free from any monetary or legal liabilities, an Encumbrance Certificate is mandatory.

Checking documents is a must inclusion in the home buying checklist

5. Knowing the Hidden Costs

While going through the home buying checklist don’t miss the point that talks about hidden costs. Apart from the price of the property, other costs are involved in the buying process. These include Goods and Service Tax (GST) for buildings that are still under construction. You will also have to pay the Property Tax, Registration charges etc. So before finalising the budget, keep in mind these additional charges and get it clarified with your builder.

6. Applying for a Home Loan

After finalising the property, the next thing on the home buying checklist is taking a loan. Home loans come with a lower interest rate than other loans. To apply for a home loan, the applicant must submit some documents to establish their KYC. Keep the following documents handy for smooth processing:

-

Passport size photographs

-

Identity proof

-

Address proof

-

Bank account statement

-

Liability Statements

-

Property documents

-

Salary certificate

-

Form-16, IT Returns copies

7. Checking RERA Certificate

RERA (Real Estate Regulatory Authority) certificate is a legal document that is provided to a property, project or property agent as proof that they have been registered under state-level RERA authority. There is a registration number on the RERA certificate that allows them to operate their business legally. It has all the information about the property, developer and project. This certificate reduces the chances of malpractices and safeguards buyers’ rights. Thus, checking the RERA Certificate is an unmissable part of the home buying checklist.

8. Researching Property Prices

To make sure that you pay the right price for the property you have chosen, detailed market research is important. Visit various websites and check the property price trends in that locality. Also, check the inflation rate of property in the past. If the price has depreciated in the last few years, then it is a red signal. Studying the price trends in the locality helps you to estimate the real worth of the property. Tick off this point on your home buying checklist once you are convinced with your research.

(Visit PropWorth by Magicbricks, an instant estimation tool to know the exact property price of any project or locality.)

9. Signing the Deal

You have almost reached the end of the home buying checklist, and now you are ready to sign the deal. The “Agreement of Sale” has mutually acceptable clauses and agrees that the property is being transferred to the buyer. The Supreme Court has defined a document called the Builder Buyer Agreement (BBA). This agreement follows a specific format to ensure more transparency in real estate transactions. The buyer’s interest will be safeguarded and will put an end to arbitrary and one-sided agreements.

10. Property Registration Process

The last leg of the home buying checklist is getting the Sale Deed registered. After the sale agreement, a sale deed is made.

-

Keep all the documents ready before the day of registration. Check the timings of the sub-registrar’s office and plan your day.

-

You must pay the stamp duty and registration charges in advance. You can pay for these online. Your lawyer can help you through this process.

-

Along with the property documents, you will need to keep your Aadhaar and PAN card handy.

-

You will also need two witnesses who will have to sign the documents. They must carry their Aadhaar Cards with them. Make sure that you bring witnesses whom you know very well.

-

If the property value is more than Rs 50,00000, you will have to show a document proving that you have deducted TDS from the property value.

-

After this, you will receive a receipt. It typically takes 15 days to register your documents.

11. Getting a Home Insurance

Planning to buy a new home or you are already an owner, the decision to buy home insurance is never late. Having spent a major portion of your earnings on building your dream home, it is obvious that you will be worried about its safety and security. Home Insurance plays an important part in the home buying checklist as it covers the expenses you might have to incur in case of any loss or damage.

-

What is Home Insurance? Home insurance is a kind of property insurance that covers damages or losses to an individual’s property. It also provides liability coverage against accidents on the property. It covers interior damages, exterior damage, damage to personal assets and injury due to an accident within the property premises.

-

How to claim Insurance? In case of any mishap, the homeowner can make claims on any of these incidents. He will have to pay an amount (deductible) and the balance amount will be paid by the insurance company.

-

What is the liability limit? Every home insurance policy has a ‘liability limit’. It is set to determine the amount of money the purchaser will get in case of any mishap. You can set a higher coverage limit so that you can rebuild and replace damaged assets. The insurance coverage helps you to pay living costs like hotel bills or house rent till your property is repaired.

-

Is it mandatory? Investing in a home insurance policy is not mandatory, but if you are taking a loan, the bank might require you to take an insurance policy to protect your investment in case of any damage to the property. Sometimes, the bank that you are taking the loan from helps you buy an insurance policy.

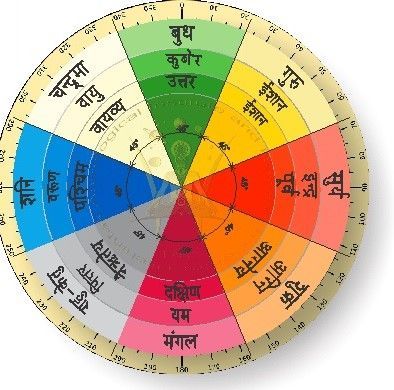

12. Checking Vastu Dosh

Vastu is often the most neglected step in the home buying checklist. It aims at taking the best advantages of nature’s elements and energy fields while creating a living space or office space. It is an amalgamation of science, art, astronomy and astrology. Vastu Shastra balances 5 elements of nature and directions and aligns them with us and our living space. Add this point to your home buying checklist and add value to your home. Vastu norms that one should not ignore while buying a house are:

-

Choose a house where all four corners are intact (not cut).

-

South-West facing houses should be avoided.

-

The kitchen should not be in the Northeast direction. The best directions for making a kitchen are the southeast and northwest.

-

The master bedroom should not be in the South-East direction. It should be in the South-West direction.

-

North-West is the best direction for toilets. North-West should be avoided.

Your Guide to House Buying by a Real Estate Professional

In this video, CEO of Magicbricks Sudhir Pai, offers expert advice on home buying parameters in today's dynamic market. From defining how to go about setting your budget, choosing a location, deciding on the property type, to checking critical parameters before the buy, as possession status, ROI expectation and more. Watch the video to get a comprehensive overview of the home buying process.

Final Word on Home Buying Checklist

With the home buying checklist in place, you can start the search for a new home. This checklist has been specially curated for you to save you from the pitfalls involved in home buying. Start dreaming and get ready to fulfil your dream of a beautiful abode by following this 12-pointer home buying checklist.

| Read More on Buying Property |

||

_80_120.jpg)

.jpg)

.png)