BBMP property tax 2025 is a direct tax imposed by the Karnataka State Government and collected through local bodies. It is primarily levied on real estate, which also includes vacant land. BBMP property tax collection is done both online and offline. BBMP property tax collection ensures smooth maintenance of civic infrastructure and amenities such as public parks, roads, cleanliness in the area, etc.

BBMP property tax is a recurring expense paid by the property owners annually. Citizens can seamlessly pay BBMP property tax online. It must be noted that the Karnataka government has started levying an ‘Urban Land Transport Cess’ of 2 per cent on BBMP property tax 2025 payment (Bangalore property tax).

BBMP property tax amount varies from one region to another. Independent buildings (residential and commercial), apartments, flats, shops, godowns, vacant land, etc., are some properties included under the BBMP Bangalore property tax.

BBMP Property Tax 2025 Payment Due Date

BBMP property tax is paid annually. The BBMP property tax payment cycle starts in April of every year and ends in March of the following year. It must be paid by March 31st of the following year.

The 5% rebate in BBMP property tax online is offered to people who pay their taxes in one instalment within the due date. In case of delay in BBMP property tax payment, an interest of 2% per month is charged. The BBMP property tax can also be paid in two installments without rebates and interest.

BBMP Property Tax Rebate

Citizens of Bangalore can get BBMP property tax rebates if they pay the taxes in one instalment. In such a case you will get a discount of 5% on the tax amount. For example, if BBMP property tax is Rs 1000 and you pay the entire amount in one instalment, you will get 5%, so you will have to pay Rs 950.

BBMP Property Tax 2025 Rates

Bangalore has been divided into six zones for the BBMP property tax calculation and collection by the BBMP. Primarily, there are six zones, and the rates are different for both tenanted and self-occupied properties. The BBMP Bangalore property tax rates are as follows-

BBMP Bangalore Residential Property Tax Rates (Zone-wise)

| Zone |

Tenanted (per sq ft) |

Self-occupied (per sq ft) |

| A |

Rs. 5 |

Rs. 2.50 |

| B |

Rs. 4 |

Rs. 2 |

| C |

Rs. 3.60 |

Rs. 1.80 |

| D |

Rs. 3.20 |

Rs. 1.60 |

| E |

Rs. 2.40 |

Rs. 1.20 |

| F |

Rs. 2 |

Rs. 1 |

BBMP Bangalore Commercial Property Tax Rates (Zone-wise)

| Zones (as classified by BBMP) |

Self-Occupied Property (Rs per sq ft) |

Tenanted (Rs Per Sq ft) |

| A |

Rs 10 |

Rs 20 |

| B |

Rs 7 |

Rs 14 |

| C |

Rs 5 |

Rs 10 |

| D |

Rs 4 |

Rs 8 |

| E |

Rs 3 |

Rs 6 |

| F |

Rs 1.50 |

Rs 3 |

BBMP Bangalore Property Tax Rates on Vacant Land (Zone-wise)

| Zones (as classified by BBMP) |

BBMP Property Tax on Vacant Land (Rs per sq ft) |

| A |

Rs .50 |

| B |

Rs .40 |

| C |

Rs .30 |

| D |

Rs .25 |

| E |

Rs .20 |

| F |

Rs .12 |

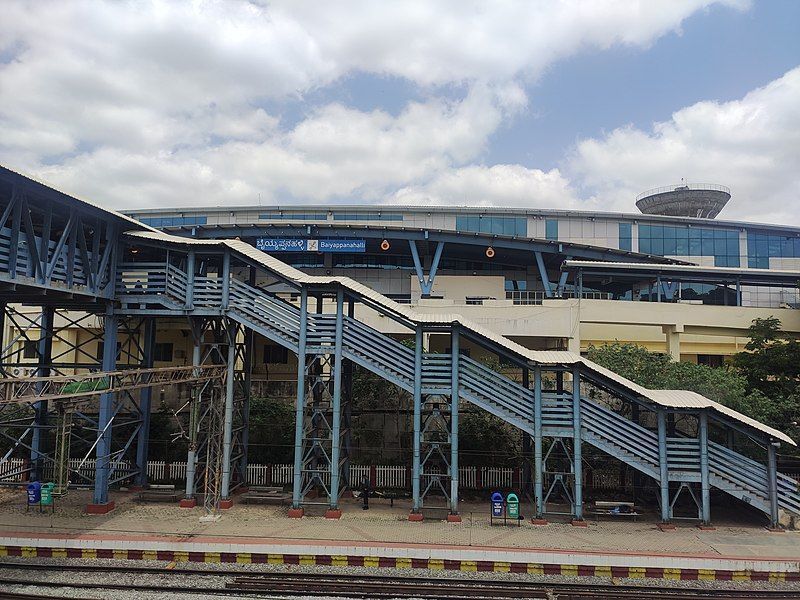

BBMP Bangalore property tax zones are as follows

In addition to the BBMP property tax, an Urban Transport Cess is also charged by the BBMP at the rate of 2 percent.

BBMP Property Tax 2025 Forms

Here is a list of six forms needed to pay BBMP property tax 2025:-

| BBMP Property Tax Forms |

Description |

| Form I |

A common form to be used by property owners who have a Property Identification Number (PID). This number contains all the details like street number, ward number, etc. |

| Form II |

In case a property owner doesn’t have a PID number, use Form II and use Khata certificate to pay the property tax. |

| Form III |

Submit form III if the PID or Khata number both are unavailable. |

| Form IV |

Also, known as white form if there are no changes or alterations in the details to be submitted. |

| Form V |

A blue form is used when there are changes in the property details. For example, a floor or ramp has been added or property has been converted to non-residential. |

| Form VI |

If a property owner is exempted from paying BBMP property tax, use form VI |

How to Pay BBMP Property Tax Online?

To pay BBMP Bangalore property tax online, follow the steps below.

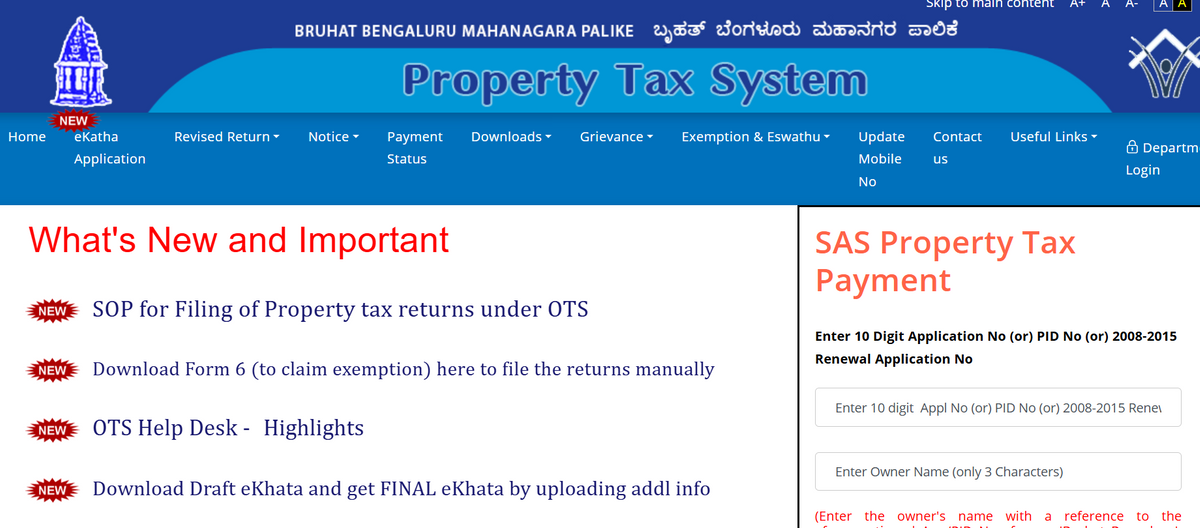

Step 1: Log in to the BBMP Tax website i. e., bbmptax.karnataka.gov.in

Step 2: Fill in the SAS (Self-Assessment Scheme) application number or PID or 2015-2018 Renewal Application Number, whichever is available on the last receipt, and click the Retrieve button. (bbmp property tax online)

To pay BBMP property tax online, enter the SAS application number

Step 3: Check the details displayed and select Proceed which will redirect to Form 4.

Step 4: In case of any changes in the property details, click on the checkbox and select Proceed which will redirect to Form 5.

Step 5: Check if all the entered details are correct and proceed to BBMP property tax online payment. The full amount can be paid once or in installments.

Step 6: Once the payment is completed, an e-receipt will be available on the portal after 24 hours and the receipt can be downloaded.

Also Read: Ready Reckoner Rates in Bangalore

Online Payment Failure while BBMP Property Tax Payment

The Bruhat Bengaluru Mahanagar Palike (BBMP) has clarified that BBMP is not responsible for double/ excess payments, online payment failure, or auto-refunds. The users must contact the respective banks. The records available on the department's website are updated in real time, and users need not visit the department to access information on BBMP Property Tax dues.

All requests for refund/chargeback of property tax payments through PayU Money and HDFC bank shall be handled by BBMP only. As may be the case, no request shall be made to PayU Money or HDFC Bank. Users must raise a ticket under the Grievance section for chargeback queries.

BBMP Property Tax: Manual Payment Methods

An Individual must fill out the application form in Bangalore One or Assistant Revenue Office and can pay BBMP property tax offline, either in cash or through Demand Draft (DD). BBMP property tax can also be paid at designated bank branches across Bangalore. The payment can be made between 9:00 AM to 12:00 PM and 3:00 PM to 7:00 PM.

BBMP Property Tax Payment Receipt Offline

A payment receipt will be generated instantly if you have paid BBMP property tax offline. If the payment is made using a cheque, then a receipt will be generated after the cheque is cleared. If payment is made online- you can download BBMP property tax by going to the BBMP Karnataka portal. The link for the same is bbmptax.karnataka.gov.in/forms/PrintForms.aspx?rptype=3. To download the receipt, enter the assessment year, application number and captcha. Click on Submit and print the receipt.How to Get BBMP Property Tax PID Number?

BBMP property tax PID number is an individual number given to each property in Bangalore. To get your Bangalore PID number, you must perform the following steps:-

-

Step 1: Visit BBMP's official portal

-

Step 2: Click on GEPTIS from the right bottom of the page, also you can use this link-http://geptis.bbmpgov.in/web/gis/welcome.

-

Step 3: Sign to the account, using the login credentials, if you are not an existing customer then you will have to do registration first.

-

Step 4: Hover on the property location on the map, and you will receive the New PID number

-

Step 5: Now, details about the property can be searched using the PID number

How is Property Tax Calculated in Bangalore?

BBMP property tax is calculated based on the per square foot tax rate per month (Unit), which is fixed based on the location and street of the property (Area) and multiplied by the current property rate (Value). The UAV is determined by the property's location, the nature of its usage, and the anticipated return.

Based on the guidance value determined by the Department of Stamps and Registration, Karnataka, the jurisdiction of BBMP is divided into 6 zones. The BBMP property tax value changes basis the zone in which the property is located.

BBMP Property tax is calculated in three different ways:

-

Annual Rental Value (ARV) System – It is also known as Rateable Value. It is calculated based on the amenities provided, size, and location of the property. The municipal body of a state fixes the gross annual rent of the property and imposes tax based on the estimated value. Chennai follows this system.

-

Capital Value System (CVS) – The tax is determined based on the property's market value. The market value is fixed by the area’s stamp duty department. Mumbai follows this system.

-

Unit Area Value (UAV) is also known as Unit Area System (UAS). It is calculated based on the per square foot tax rate per month (Unit) which is fixed based on the location, street of the property (Area), and multiplied by the current property rate (Value). Bangalore follows this system.

BBMP Property Tax Calculation Formula

In Bangalore, the property tax can be easily calculated by using the Tax Calculator on the BBMP website. The formula used to calculate property tax is:

Property Tax (K) = (G-I) * 20% + Cess (24% of property tax)

Here G is Gross Unit Value, which is obtained by X+Y+Z

X – The tenanted area of the property * 10 months * per sq ft rate

Y – A self-occupied area of the property * 10 months * per sq ft rate

Z – Vehicle parking area * 10 months * per sq ft rate

I=(G*H)/100

I – Depreciation amount

H – Percentage of depreciation rate, that is calculated based on the age of the building

Types of Properties Charged with BBMP Property Tax in Bangalore

The properties which are covered under the ambit of BBMP property tax are-

- Flats

- Factories

- Offices

- Residential houses (both occupied and rented)

- Go downs

- Shops

Things to Remember before Calculating BBMP Property Tax

If you are a new taxpayer, you should keep the following details ready while calculating BBMP property tax.

-

Annual value of the property

-

Property type- residential, industrial or commercial

-

Property dimension

-

Built-up area of property

-

Floors in the property, including the basement

-

Built-up area of individual floor

How do you check the payment status of BBMP Property Tax Online?

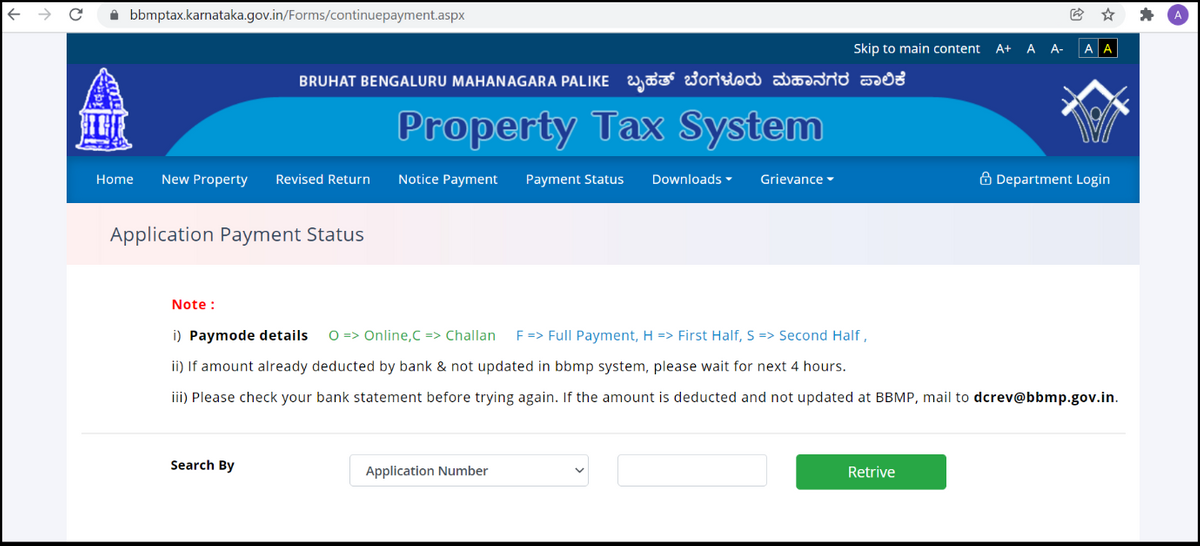

After paying the BBMP property tax online, you can check the payment status. To check the status of BBMP property tax online, follow the steps below.

Step 1: Log in to the official website of BBMP, i.e., bbmptax.karnataka.gov.in

Step 2: Click on the ‘Payment Status’ tab on the home page.

Step 3: You will be redirected to the following window.

Step 4: You can search BBMP payment status by

-

Application number

-

Challan or Transaction Number

Select the appropriate option and click on the retrieve button. The details will be displayed on the screen.

BBMP suggests that citizens check the BBMP property tax payment status online to check their respective bank statements before trying again. If the fee amount was deducted and not updated at the BBMP site, you can email dcrev@bbmp.gov.in.

How to Download or Print BBMP Property Tax Receipts on BBMP Website?

To download the BBMP property tax receipt, follow the steps below.

Step 1: Log in to the official website of BBMP, i.e., bbmptax.karnataka.gov.in

Step 2: Click on the ‘Downloads’ tab on the home page.

Step 3: You can download/print BBMP property tax receipt such as

-

Receipt print

-

Challan Print

-

Application Print

Mistakes to Avoid When Paying BBMP Property Tax Online

It is important that you avoid making certain mistakes when paying your BBMP property tax online to ensure smooth and accurate tax payment. Find a few major ones below.

-

Providing incorrect details such as property number, address, or owner’s name

-

Not claiming exemptions or rebates you are eligible for, such as deductions for senior citizens or the 5 per cent early payment discount

-

Providing incorrect details of the built-up area or measurement of your property

-

Performing incorrect tax calculation

-

Missing the payment deadline or making late BBMP property yax payment, leading to fines or penalties.

-

Classifying the property under the wrong category (residential, commercial, etc.)

-

Failing to update the property records in case of any changes such as construction or renovation

-

Submitting without verifying that the payment has been properly credited

-

Not updating the tenant or lease information, if applicable

-

Not downloading payment receipts after completing the transaction

Contact Information for BBMP Property Tax

For more information about BBMP property tax, you can contact the following numbers:-

| Zone |

ZC office Address |

Email ID |

| Yelahanka |

Byatarayanapura, Amruthahalli Main Road, Bangalore-92 |

kareegowdacs@gmail.com |

| Mahadevapura |

R H B Colony, ITPL Main Road, Opp of Phoenix Mall, Mahadevapura-560048 |

zcmdpbbmp@gmail.com |

| Bommanahalli |

Begur Main Road, Old CMC Building Bommanahalli, Bengaluru- 560068 |

zcbommanahalli@gmail.com |

| Dasarahalli |

Hesarugatta Main Road, Bagalahgunte, MEI Layout, Bengaluru-560073 |

zonalcommissionerdas@gmail.com |

| RajarajeshwariNagar |

18th Cross Road, Ideal Home's Layout, R R Nagar, Bengaluru - 560098 |

zcrrnagarzone@gmail.com |

| East |

Public Utility Building, M G Roadm Bengaluru-560001 |

bbmpeastzone@gmail.com |

| West |

Sampige Road, Opp of Mantri Mall, Bengaluru-560003 |

zc-west@bbmp.gov.in |

| South |

BBMP Complex,9th Cross, 9th Main, 2nd Block Jayanagar, Bengaluru 560011 |

zcsouthbbmp@gmail.com |

Conclusion on BBMP Property Tax

Conclusively, Bangalore property tax payment is a yearly activity, and it can be done both online and offline. The money collected via BBMP property tax is utilised in ensuring better civic and social amenities in Bangalore. Login to the official website of BBMP Bangalore and pay BBMP property tax online.

.png)

.jpg)